BioSign

- Iris and the Retina

- Face

- Fingerprint

Why fingerprint?

According to the International Biometric Group and Acuity Market Intelligence in the global biometric market fingerprints lead and take up 60% of the market by:- Uniqueness - Fingerprint unique to each individual and does not change throughout life. The fingerprint is used as the main form of biometrics in national and international systems of law enforcement agencies around the world.

- Economy - Used equipment acceptable cost (fingerprint scanners are cheaper than other biometric scanners).

- Amenities - Contains the largest number of backup IDs (the common man at the hands of 10 fingers and only one face, two eyes, two hands).

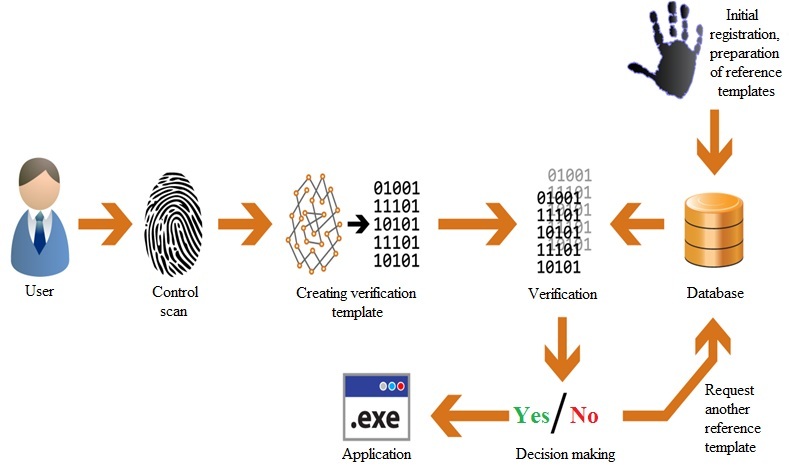

Components of a biometric access system

- Subsystem for initial registration and preparation of the reference template of a new member

- Storage reference patterns

- Subsystem control scanning and creating digital control template

- Computational comparison module reference and test patterns

- Analytical decision module of pattern matching

- Interface for interfacing with external infrastructure

Scheme of the biometric system

Biometrics defines a number of terms:

- Biometric template - the biometric template. Data set, usually in a closed binary format, prepared by a biometric system based on the analyzed characteristics.

- Verification - comparison of the two biometric templates, one for one.

- Identification - identification biometric template human sample some other patterns. Ie identification - it is always one-to-many comparison.

Algorithms for fingerprint recognition:

There are two main algorithms used for fingerprint recognition:- Algorithm based on the allocation of points;

- Algorithm is based on comparison of patterns;

Technology Precise BioMatch

The Swedish company Precise Biometrics is one of the leaders in the design and manufacture of security systems using fingerprint technology (biometric fingerprint authentication).

Continuous research and development of Precise Biometrics has led to the creation of a more accurate biometric authentication technology, which unites both methods in one hybrid algorithm. The result is a technology Precise BioMatch, which has all the best of both methods.

Its principle of operation is that when comparing fingerprints are used and the singular points, and the whole region. Thus, it is a universal method that can be used to solve a variety of banking tasks. This technology is already running in the United States government agencies to authenticate employees. As well as national identity cards (ID) in countries such as Portugal, Thailand, Qatar.

Hardware-software system «BioSign»

The hardware-software system biometric access to deposit accounts «Biosign» consists of two parts:Hardware:

- Server

- Fingerprint scanner

- Biosign manager

- Precise BioMatch ANSI 378

- Precise BioMatch Flex

How does it work:

Data processing system «Biosign» is based on technology Precise BioMatch. System «Biosign» works in on-line mode with the ORACLE database or MySQL. Operation of the system «Biosign» begins with registration of the client. BioSign stores templates in the form of a digital code converted from these images. Creates a database of fingerprints of bank employees. It easily integrates with any system. Its interface is extremely simple, easy and self-explanatory. Offers versatility and maximum flexibility.

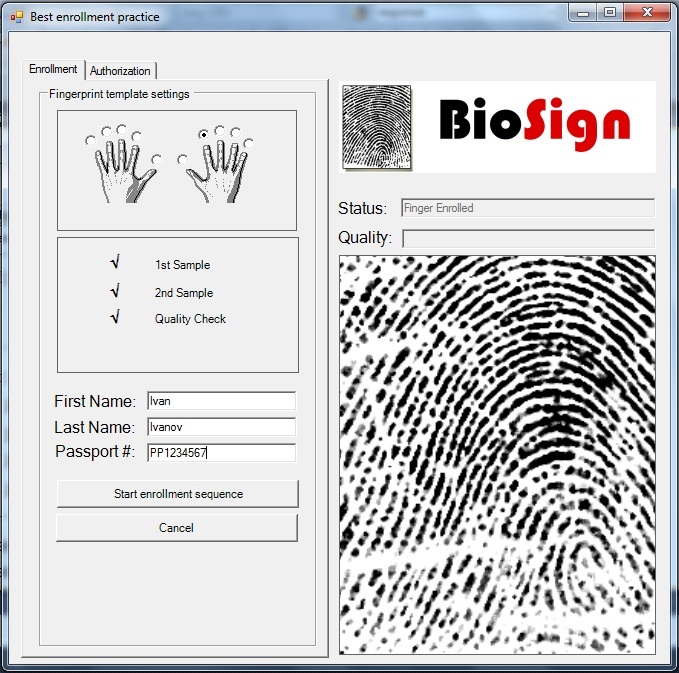

Client registration

In order to register the customer, the operator of the bank enters the necessary data (name, passport number, identification number, etc.) in the appropriate fields of the Programme and presses the "registration". When you click "register" the program calls the appropriate function BioSign Client. Thereafter, the procedure for scanning a fingerprint of the Client, convert it into a unique digital code technology Precise BioMatch and write to the database as a digital fingerprint of the client code.

This digital code stored in the database as a reference a specific client with the corresponding record. If necessary, the contents of the fields of the electronic document is encrypted.

In this registration process ends.

Client verification

If the client wishes to make or take money from your account, the bank's operator enters customer ID number in the appropriate fields of the Programme and clicks "Submit". The program calls the appropriate function BioSign Client. After that, the procedure starts with fingerprint reader Depositor and sent to the server. Then invoked Databases standards fingerprints and compared on the server. If the comparison is successful, the transaction is made on entering or withdrawals.

Following the success of the transaction or for making withdrawals from the account server will print a check to the Investor on the conduct of monetary operations, specifying the amount. Depositor goes to the cashier with a check for the cash transactions.

Thus, the Investor is directly involved in carrying out the transaction as to deposit money and to withdraw money from the account.

Advantages of «BioSign»

- The uniqueness - Identified by a specific person, not a password, key or card.

- Security - Impossible rejection of Action confirmed the biometric identifier. It is impossible to forget, to kidnap, "spy" clone finger.

- reliability - Biometric identifiers have no restrictions on the number of readings. Offers the possibility of backup IDs.

- Ease - Natural simplicity and ease of use.

System «BioSign» prevent such risks as:

- Preparation of deposit under other name or forged documents.

- Attempt to access deposit accounts in other people's documents.

- Manipulation of the bank's employees to deposit accounts.

- Challenging client transactions on deposit accounts.

- Eliminates the human factor of obtaining illegal funds in collusion with the bank.